Of course, automatic stabilizers should not be the only determinant of discretionary programs. Also, our results support the argument that countries that have enacted smaller stimulus programs were countries with more automatic stabilizers. While it is clear that balanced budgets need to be achieved in the medium-run, it is important to take into account the impact of reforms on automatic stabilizers. Our findings have important implications for the ongoing policy debate about institutional reforms following the sovereign debt crisis. These results are interesting because they shed new light on the factors determining the fiscal policy response of governments to the crisis. This suggests that policy makers may indeed have taken into consideration the strength of automatic stabilizers when they decided how much to spend on discretionary fiscal policy packages in the crisis. Our empirical analysis points to a robust negative relationship between these two pillars of fiscal and social policy. We relate these estimates of automatic stabilizers to new information on discretionary fiscal stimuli.

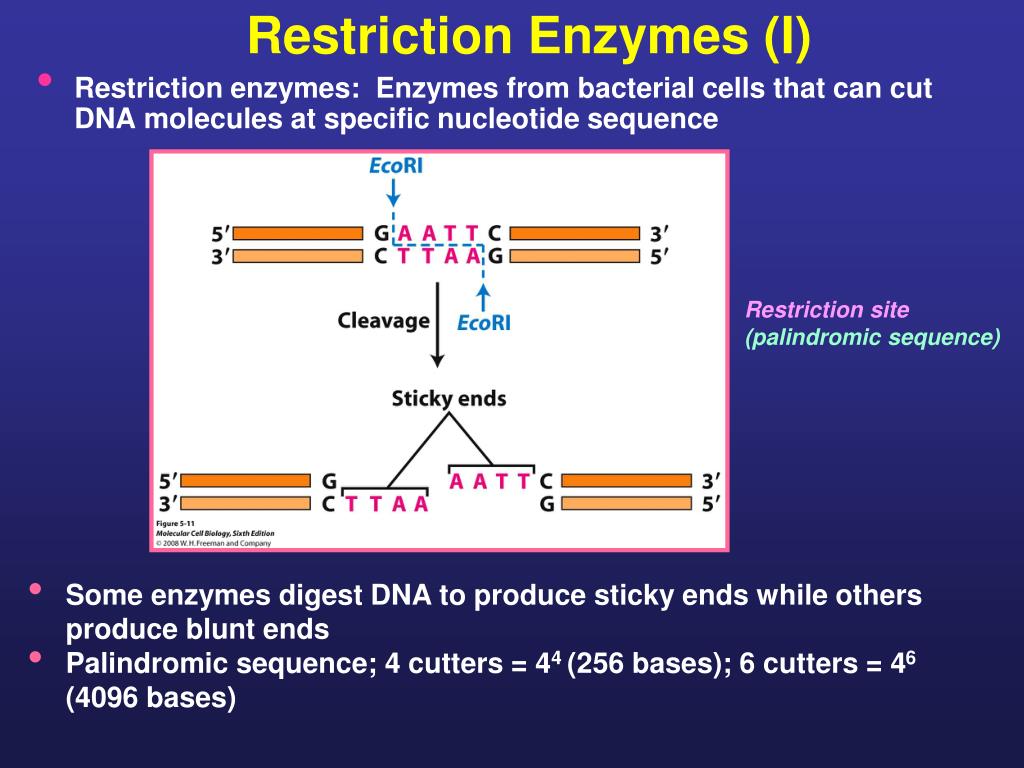

Palindromic sequences plus#

2012) which investigates the magnitude of automatic stabilizers inherent in the tax and transfer systems of 19 EU countries plus the US 1. We build on former work (see Dolls et al.

As final data on fiscal stimulus packages during the recent economic crisis are now available, it is possible to shed light on this relationship. Understanding the relationship between automatic stabilizers and discretionary fiscal policy is crucial, because countries with larger automatic stabilizers have to rely less on discretionary fiscal stimulus packages, other things being equal. Therefore, especially for the recent crisis, it is important to assess the contribution of automatic stabilizers to the overall fiscal expansion and to compare their magnitude across countries. This action included a broad range of measures such as (payroll) tax cuts, employment incentives, activation policies, higher benefits and increased transfers to low-income households. The automatic action of tax-transfer policies was accompanied in most countries by discretionary action in the field of tax, social and labor market policy. Due to differences related to the structure and financing of the tax benefit system, the degree of automatic stabilization was bound to vary across countries.Īutomatic stabilizers are widely seen to play a key role in providing income insurance for households and hence in stabilizing demand and output. During the recent crisis, the tax and benefit system has acted as an automatic stabilizer on both the revenue as well as the expenditure side of the general government budget. In particular, automatic stabilizers provide income replacement immediately when unemployment starts to rise. Automatic stabilizers are usually defined as those elements of fiscal policy which reduce tax burdens and increase public spending without discretionary government action.

Much less attention has been devoted to the workings of automatic stabilizers. While it is uncontroversial that both the magnitude of the economic contraction during the crisis and its effects on labor markets were attenuated considerably by the work of automatic and discretionary stabilization, a large part of the resulting policy debate has focused on the size of discretionary fiscal policy plans and on rescue packages for banks. The recent recession triggered by the financial crisis has had a severe impact on incomes and employment around the world and especially in Europe (OECD 2012). This raises the general question of whether countries with weaker automatic stabilizers have taken more discretionary fiscal policy action to compensate for this. One reaction to this criticism was to point to the fact that automatic stabilizers in Germany are more important than in other countries, so that less discretionary action is required. In the debate on policy responses to the recent crisis, some countries have been criticized for being reluctant to enact fiscal stimulus programs in order to stabilize demand, in particular Germany.

0 kommentar(er)

0 kommentar(er)